2024 Business Auto Deduction Calculator

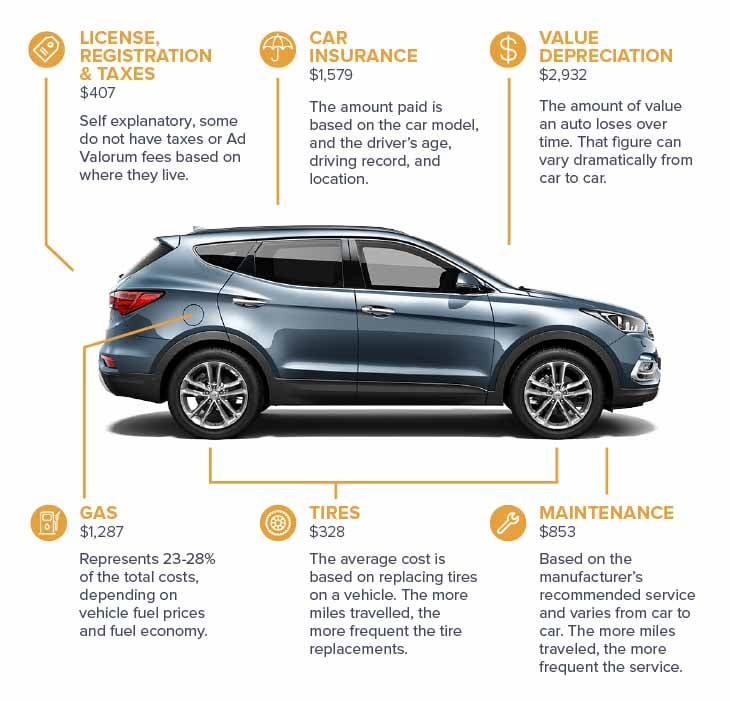

2024 Business Auto Deduction Calculator – If your total itemized deductions are less than the standard deduction, the calculator will use the standard deduction. Enter your total 401k retirement contributions for 2022. For 2022 . Keep an eye on your chosen car’s fuel economy using online miles-per-gallon calculators they don’t realize they can deduct car insurance premiums and expenses beyond deductibles if the car is used .

2024 Business Auto Deduction Calculator

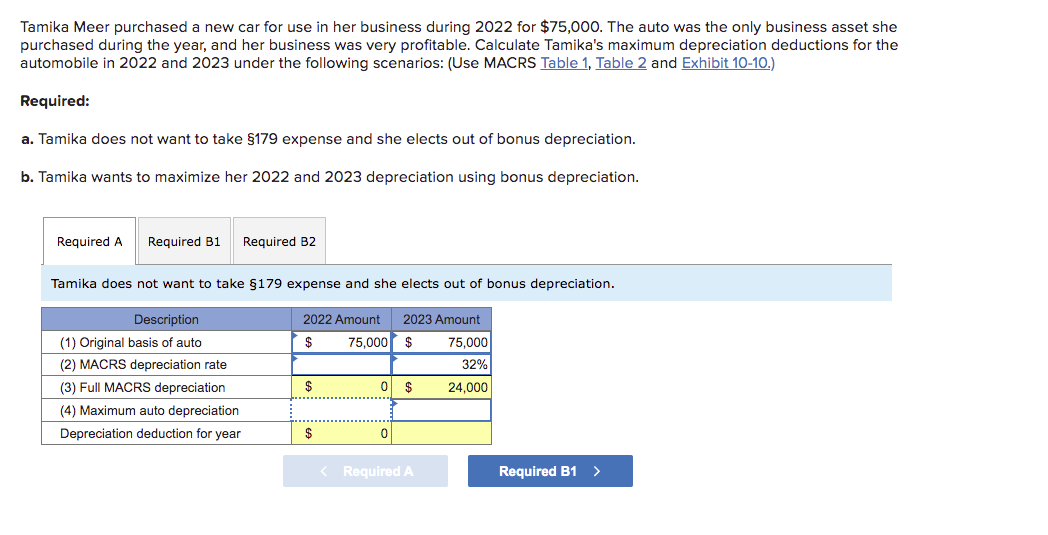

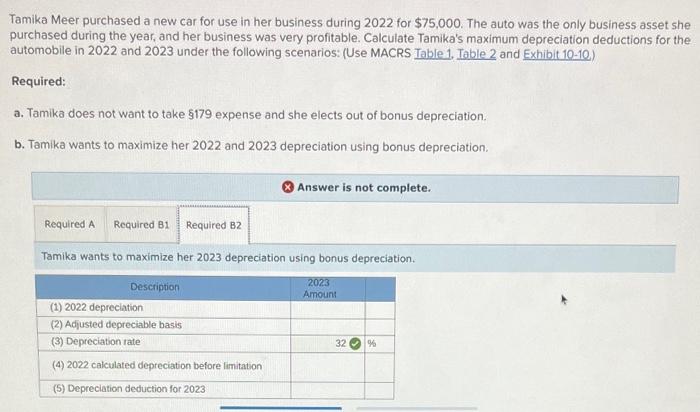

Source : www.hecouncil.orgSolved Tamika Meer purchased a new car for use in her | Chegg.com

Source : www.chegg.com22 Small Business Tax Deductions Checklist For Your Return In 2024

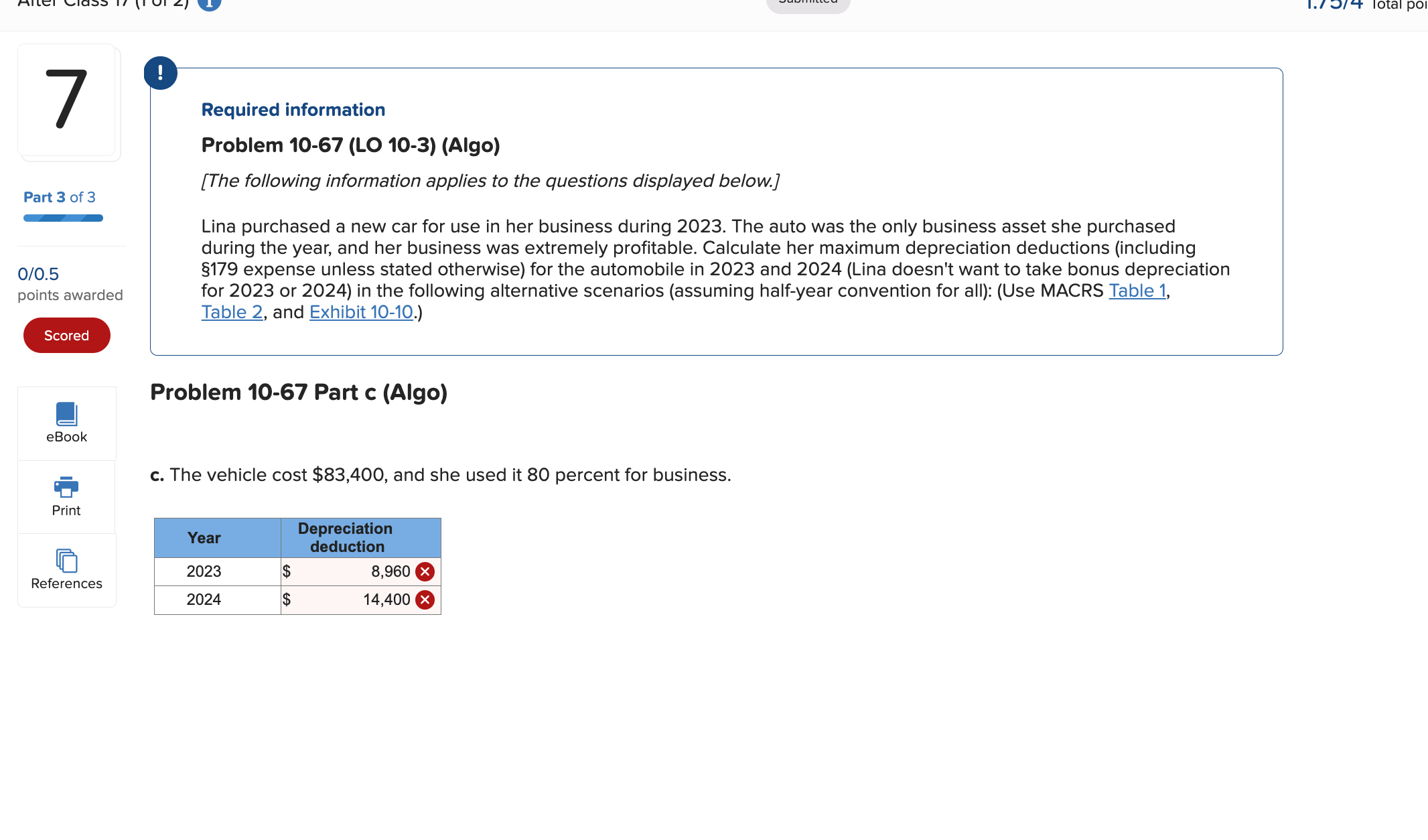

Source : www.insureon.comSolved Lina purchased a new car for use in her business | Chegg.com

Source : www.chegg.comBuy Business Mileage Tracker & Auto Mileage Expense Deduction

Source : www.etsy.com🚨 Important Message for INC Indy Nanny Concierge | Facebook

Source : m.facebook.com22,831 Burden Business Royalty Free Images, Stock Photos

Source : www.shutterstock.com2024 Everything You Need To Know About Car Allowances

Source : www.mburse.comOur Financial Blog | Useable Advice and Tips | Trajan Wealth

Source : trajanwealth.comSolved Tamika Meer purchased a new car for use in her | Chegg.com

Source : www.chegg.com2024 Business Auto Deduction Calculator Hawaii Employers Council IRS Issues Standard Mileage Rates for 2024: If you purchase assets for your business during the tax year for allowing a company to purchase an SUV and deduct the entire cost of the vehicle. However, this ability was limited in 2020. . With tax season underway, you’ll need to know the standard deduction amount you can claim for 2023. The standard deduction amounts tend to increase slightly each year to adjust for inflation. Let’s .

]]>